Old Mutual Zimbabwe has launched the Old Mutual Renewable Energy Fund, a private equity fund dedicated to fostering renewable energy investments in rthe country.

The fund is registered with the Securities and Exchange Commission with Old Mutual, the Government of Zimbabwe, and various UN agencies as its key initial investors.

The Old Mutual Renewable Energy Fund is designed to finance and develop local renewable energy projects, initiatives, and technologies, aligning with Zimbabwe’s goals to meet its Sustainable Development Goals (SDGs).

Specifically, the fund targets SDG 7: Affordable and Clean Energy, SDG 9: Industry, Innovation and Infrastructure, and SDG 11: Sustainable Cities and Communities. This initiative aims to catalyse sustainable economic development while supporting the nation’s carbon reduction commitments.

Speaking at the launch, Samuel Matsekete, the chief executive of the Old Mutual Group, said, “Our commitment to investing in renewable energy is evident in our strategic focus on solar and hydro-energy projects. These ventures align with our mission to promote sustainable development and provide tangible solutions to Zimbabwe’s energy challenges. By harnessing the sun’s power and our abundant water resources, we are paving the way for a cleaner, more resilient energy future. The Old Mutual Renewable Energy Fund is a testament to this commitment.”

Matsekete stated, “The fund brings together partners such as Old Mutual, the Government of Zimbabwe, UN agencies, and private sector investors. This fund aims to provide financial returns and social impact, benefiting investors and those involved in renewable energy projects along the value chain. Our target is $100 million, with $20 million already committed to specific projects.”

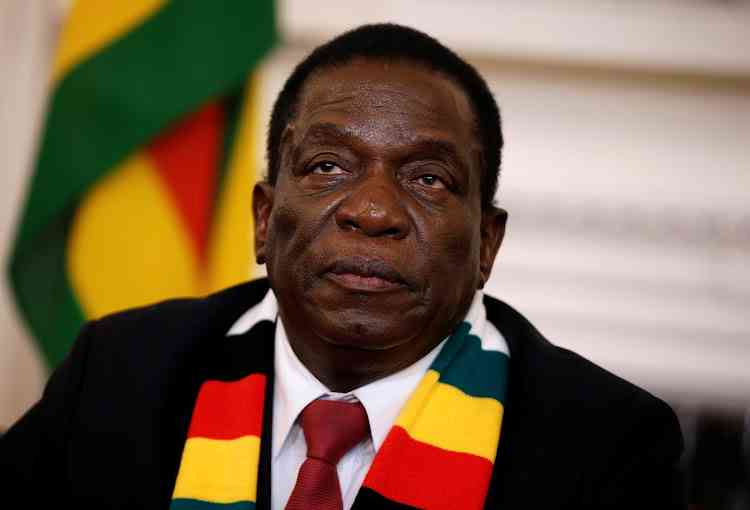

The initiative has received positive feedback from the Government of Zimbabwe; speaking at the launch event, Gloria Magombo— Secretary for Energy and Power Development said, “The National Renewable Energy Policy envisages that the country should add 2100MW of renewable energy or 26.5% of RE contribution by 2030. More importantly, the Policy clearly pronounces that a Green Fund responsible for funding renewable energy and energy efficiency projects shall be established. Thus, this fund is a key milestone in the implementation of our Renewable Energy Policy. The launch of the fund is clearly part of the resource mobilization that is crucial for achieving our Renewable Energy targets.

Marjorie Mayida, managing director of Old Mutual Investment Group, reaffirmed the company’s commitment to promoting economic growth and sustainable renewable energy sources. She stated, “The Old Mutual Renewable Energy Fund is not only a solid financial opportunity but also a chance to contribute to a sustainable and prosperous Zimbabwe. By investing in this fund, you align your resources with a vision that prioritises responsible growth and well-being of our community.”

- Directors move to tackle governance crisis

- Women demand financial sector overhaul

- Old Mutual tech hub trains start-ups

- US$10m boost for Zim renewable energy projects

Keep Reading

Speaking at the launch, Edward Kallon- UN Resident Coordinator, said, “Today’s event marks the convergence of ideas, partnerships and investments aimed at addressing one of the most pressing challenges of our time- climate change and the critical role of renewable energy in achieving the Sustainable Development Goals (SDGs). The Renewable Energy Fund, managed by Old Mutual, is aimed at providing much-needed financial support for renewable energy projects across Zimbabwe. What sets this Fund apart is its innovative blended finance model. By leveraging both public and private capital, the Renewable Energy Fund will finance projects that are both bankable and socially impactful. This model has been designed with sustainability at its core- ensuring that investments are viable while achieving key SDG targets, including energy access (SDG7), climate action (SDG13) and gender equality (SDG5).”

Magombo added, “Investment in the energy sector, especially renewable energy, will assist in powering the envisaged Upper Middle-Income Economy. The importation of power from other countries is costly and usually results in higher tariffs, affecting our economy. The higher power costs are generally felt by the ordinary citizens who have numerous other socio-economic challenges. With the operationalization of this Fund and additional investments in large-scale renewable energy projects, we expect to be energy self-sufficient in the near future.”

The Fund aims to attract both local and international investors who are passionate about sustainability and recognise the potential of renewable energy in Zimbabwe. The fund will help facilitate innovation and infrastructure development that aligns with the country’s long-term economic and environmental goals through strategic investments.

The Old Mutual Renewable Energy Fund offers stakeholders and potential investors a transformative opportunity to impact Zimbabwe’s sustainable future. Investing in this fund can contribute to renewable energy projects while aligning your resources with a vision of responsible growth and community well-being.