Shame Makoshori

Follow Shame Makoshori on:

Rampaging inflation hits Old Mutual . . . giant slips to $9 billion loss after tax

Old Mutual chairperson Kumbirayi Katsande showed that the ramifications of steep inflation had already exerted weight on one of Zimbabwe’s biggest financial services firms

By Shame Makoshori

Aug. 30, 2022

Banker demands $21m from land developer

Alpha has been undertaking some of the country’s key housing developing projects in urban centres, including Harare, Bulawayo and Beitbridge.

By Shame Makoshori

Sep. 1, 2022

Stanbic profits surge on back of forex loans

Gregory Sebborn, the Stanbic chairperson, said the bank shrugged off headwinds including a relentless inflation and steeper surges in interest rates

By Shame Makoshori

Sep. 4, 2022

Strong prospects for resurgence run into the sand

The bulk of handicaps confronting Zimbabwe’s economy are internal, according to a report by advisory firm Morgan&Co.

By Shame Makoshori

Sep. 7, 2022

'Govt dipping fingers everywhere'

Government has been dipping its fingers everywhere through policy shifts.

By Shame Makoshori

Sep. 8, 2022

Zimbabwe crisis a boon for neighbours

The Morgan&Co said the bulk of handicaps confronting Zimbabwe’s economy were internal.

By Shame Makoshori

Sep. 11, 2022

Comesa panics over Tiger Brands toxic products

Tiger Brands’ products maintains a huge presence on the domestic market.

By Shame Makoshori

Sep. 13, 2022

Roads closed for Mbudzi Intercharge

The Mbudzi Interchange is the highlight of government’s infrastructure revamp under the National Roads Rehabilitation Programme.

By Shame Makoshori

Sep. 14, 2022

PPC bullish after Zim forex bonanza

The cement manufacturer said there was a robust surge in US dollar inflows during the period, which was bolstered by price hikes.

By Shame Makoshori

Sep. 15, 2022

Top guns sign off with $2,4 billion windfall..Dairibord, POSB shareholders pampered

Mandiwanza exits the operation this month after helping it expand from a milk-only outfit to a broader beverages giant previously under state control.

By Shame Makoshori

Sep. 16, 2022

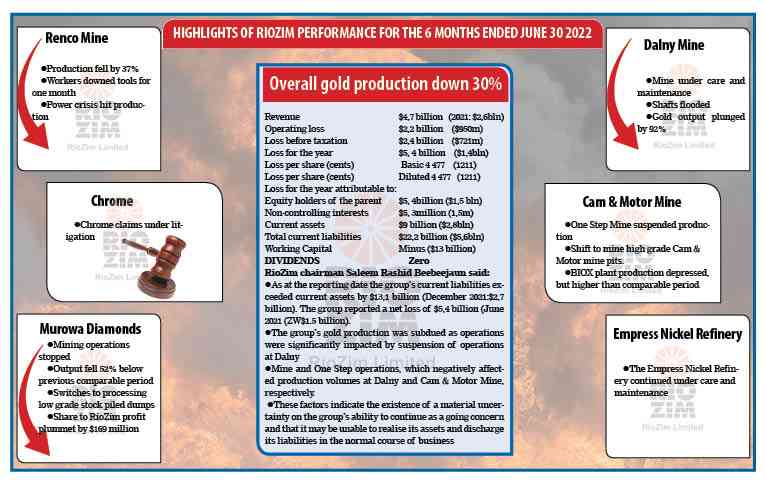

RioZim burns $13 billion

The results, published yesterday, confirmed fears of a drastic deterioration of operations at RioZim which saw a trade union file a plea with multiple regulators.

By Shame Makoshori and Rugare Mubika

Oct. 4, 2022

RioZim blames RBZ for operational woes

This figure was ZW$1,4 billion (about US$2 million) during the comparable period in 2021.

By Shame Makoshori and Rugare Mubika

Oct. 7, 2022

Shareholders pump $19bn into troubled RioZim

Dalny Mine slipped into care and maintenance and its shafts were subsequently flooded.

By Shame Makoshori

Oct. 10, 2022

Dangers lurk in Zim’s appetite for US$, Euro debts

Zimbabwe’s total debt was estimated at about US$17,2 billion at the end of last year,

By Shame Makoshori

Oct. 18, 2022

Cash crunch bites banks

The BAZ president said at the onset of the grinding liquidity crisis in 2016, banks had under their stewardship a combined 1,5 million accounts.

By Shame Makoshori

Oct. 21, 2022

Banks open 4,4 million accounts to tackle cash crunch

The BAZ president said at the onset of the grinding liquidity crisis in 2016, banks had under their stewardship a combined 1,5 million accounts.

By Shame Makoshori

Oct. 21, 2022

Mauritius Finance tips planned Vic Falls financial centre to drive Zim FDI

"I am excited by plans to establish the Victoria Falls Offshore Financial Services Centre," Bussawah said.

By Shame Makoshori

Oct. 22, 2022

Nedbank Zim heads for VFEX

Nedbank is a unit of the Johannesburg Securities Exchange-listed Nedbank Group, whose footprint spans across southern Africa.

By Shame Makoshori

Oct. 24, 2022

Toxic debt terrifies authorities..…Zim ratios below global benchmarks, penalties mount

The Zimbabwe Public Debt Management Office said while the country’s ratios fell within internal benchmarks, they were way below key international benchmarks.

By Shame Makoshori

Oct. 25, 2022

Simbisa unveils broad VFEX listing roadmap

VFEX, which trades exclusively in US dollars, was well-placed to help Simbisa execute its African forays, while improving the liquidity of its stocks.

By Shame Makoshori

Oct. 26, 2022

IPP policy revamped

This precipitated a backlash from the IPP, which raised contractual violation claims.

By Shame Makoshori

Oct. 28, 2022

BNC stumbles on tougher ore, sounds alarm on profits

BNC, which trades its stock on the Victoria Falls Stock Exchange, projected in filings with the bourse that profits for the half year ended September 30, 2022 would plummet by 193%.

By Shame Makoshori

Nov. 13, 2022

Mop up drains $9bn out of market…but high policy rate may stifle lending, cautions FCB

In its report, FCB said $9 billion was drained out of the market.

By Shame Makoshori

Nov. 14, 2022

Padenga halts croc meat exports as EU tightens screws

EU markets maintain a tight regime of regulations such as prescribing requirements for the preparation of crocodiles, their bodies, meat, organs and other parts.

By Shame Makoshori

Nov. 15, 2022

EcoCash swings back into profitability

EcoCash lifted inflation-adjusted pre-tax profit to $911,1 million in the six months, rising from a $106,2 million loss during the comparable period.

By Shame Makoshori

Nov. 16, 2022

14,3m throng Simbisa outlets post COVID-19 lockdowns

The 14,3 million represented a 36,2% rise in traffic from 10,5 million during the comparable period in 2021, according to chief executive officer, Basil Dionisio.

By Shame Makoshori

Nov. 17, 2022

Ncube fixates on inflation fight..… as fiscal pain gets worse for majority

The annual inflation rate was estimated at 268% last month.

By Shame Makoshori

Nov. 25, 2022

Power plant shutdown imperils growth targets… experts see headwinds in ZRA’s radical Lake Kariba action

Before the 2018 bold revamp, Kariba had a 750MW installed capacity.

By Shame Makoshori

Dec. 2, 2022

Treasury chief sees FDI spinoffs in new IFRS move

Ncube said adopting the standard early would also bring opportunities for capacity building to accountants and auditors in Zimbabwe from ISSB.

By Shame Makoshori

Dec. 2, 2022

Droughts, floods hamper NDS1

The government rolled out Vision 2030 in 2018, undertaking to transform Zimbabwe into an upper middle-income economy within 12 years.

By Shame Makoshori

Dec. 4, 2022

Tsvangirai turning in his grave, says Chamisa

News

By Tatenda Kunaka and Nqobani Ndlovu

Feb. 15, 2026